Mohsin Dada with Hillary Clinton

Dada reports record breaking deposit of $5.6 billion

Chairman Dada of ISDLAF+ reports record breaking deposit of $5.6 billion. This is quite an achievement for a fund which started in March 26th of 1984 with $400. Read Mohsin Dada’s 2006 Chairman’s Letter.

Dada received Distinguished Eagle Award

Mohsin Dada, the assistant superintendent of business services for School District 54, was named one of the top four school business officials in the nation by the Association of School Business Officials International.

“As a chief school business official, I am committed to continuously improving the services I offer for the benefit of children and our stakeholders,†Dada said.

The Eagle Awards honor school business officials who exemplify leadership in the profession. These are the highest honors ASBO International bestows upon its members. Four awards are given out each year during ASBO International’s Annual Meeting, which is being held this year on Oct. 21 in Boston, Mass.

Dada will receive the Distinguished Professional Eagle Award. In addition to the honor, he will be presented with a $2,500 scholarship to be given to a high school student, a crystal eagle mantel piece, an invitation to attend ASBO’s Eagle Institute in Washington, D.C., and recognition in the news and trade media.

Illinois General Assembly recognizes Mohsin Dada.

“Representatives wish to congratulate Mohsin Dada on being named one the top four school business officials in the nation by the Association of School Business Officials International (ASBO International) and being awarded the organization’s Distinguished Professional Eagle Award.”

View the official  House Resolution (pdf).

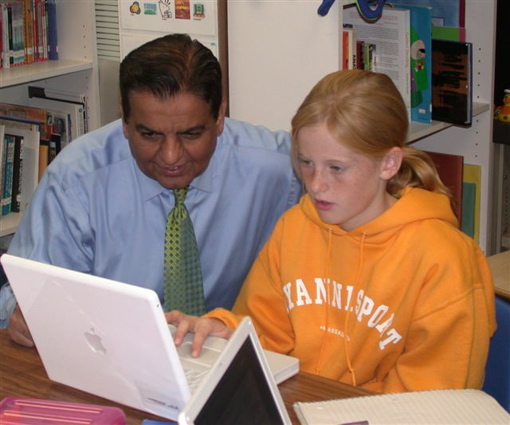

Mohsin Dada at Work

Mohsin Dada Welcomes Guests to the Conference

ASBO Annual Meeting Pittsburgh

Eagle Award Ceremony

Mohsin Dada Battles The Rapids

Skyrocketing Healthcare Costs: Is There a Cure?

By Thomas A. Kersten, Roosevelt University, Schaumburg and Mohsin Dada, Schaumburg CCSD 54, Schaumburg

Public school districts throughout Illinois continue to experience weakening financial positions as revenues remain relatively flat and expenditures, which are most typically driven by salary and benefit costs, rise at a rate which far exceeds that of inflation. As Illinois’ economy continues to flounder, school districts cannot expect to receive any revenue-side help from the State. Rather, school districts must contend with ongoing property tax cap restrictions and an unsympathetic legislative environment all while watching the costs for goods and services, generally not subject to any governmental limitations, continue to increase. Given this dismal financial picture, it is no wonder that presently over 80% of Illinois school districts currently operate with budget deficits (IASA, 2004). However, what might be even more indicative of the depth of the school district financial problems is the number of school districts with multi-year budget deficits. During FY 2003 alone, twenty-six percent Illinois school districts had experienced deficits for three or more consecutive years (Schiller & Steiner, 2003).

National Health Care Costs

One of the most significant expenditure issues for school districts is the escalating costs of healthcare coverage for employees. All across the nation school districts as well as businesses have watched as medical costs and health insurance premiums have consistently outstripped the rate of inflation. According to the United States Department of Labor Bureau of Labor Statistics, while the Consumer Price Index for All Urban Consumers (CPI-U) averaged a modest 2.4% increase per year for the period from 1999 to 2003, the average cost for medical care rose an average of 4.24% annually during this same period (BLS, 2004).

School districts, similar to businesses, have felt the pressures associated with healthcare cost increases but, unlike private companies which do not have imposed revenue limitations, were far more affected. Because of minimal state aid increases coupled with inflation-indexed tax cap restrictions, the almost 2% average differential between the CPI-U and medical care inflation rate has exacerbated the financial challenges school districts face. Simultaneously, employees themselves have experienced their own health insurance premium cost increases, typically at a rate which reflects the burgeoning costs of medical care. In fact, during the four year period from 2000 to 2003, employees across the nation watched their health insurance premiums increase 48.9% (CNN, 2004). A recent survey of school business officials conducted by the Association of School Business Officials (ASBO) found that the biggest concern that members face in their present position is rising healthcare costs (Miller, 2005).

Unfortunately, no end is in sight since these increases are likely to continue for the foreseeable future. Premium cost data for 2004 are now in and show that all four major healthcare plan options: conventional fee for service, health maintenance organization (HMO), preferred provider option (PPO) and point of service (POS) experienced double digit increases averaging 11.2% (Kaiser Family Foundation, 2004).

Medical costs have driven up health insurance premiums nearly to the $10,000 mark for a typical family. In 2004, the national annual average for single health insurance coverage was $3,695 while family coverage was $9,950 (Kaiser Family Foundation, 2004). Recent surveys of insurance providers indicate that even HMO premiums are expected to increase by 10% in 2005 with other plans experiencing similar increases (Sloane, 2004).

School District Challenge

Since school districts operate with very little wiggle room to substantially reduce expenditures without a concomitant impact on essential programs and services (Kersten & Armour, 2004), school district administrators often find themselves in a similar position to tightrope walkers who try to maintain their balance in a precarious situation. With salary costs relatively fixed through collective bargaining and minimal room for significant program and service cuts, a realistic question is – where might school district administrators turn to look for ways to reduce expenditures or at least flatten the rising expenditure projection line? The answer may lie in health insurance where they may have some flexibility, even within pre-existing collective bargaining agreements, to work together with employees and insurance providers to control costs.

School district business officials know that as the cost of health insurance escalates, the percent of school district budgets devoted to Board costs for healthcare also increases. In fact, many school district routinely budget at least 9% for health insurance costs. Not surprisingly, a study of 2005 premium increases projects this trend to continue at a lower level than recent years but still significantly above average projected revenue increases. Overall, health insurance premiums are projected to increase in 2005 by an average of 8%. The graph below highlights the anticipated rate increases for the two predominant healthcare options offered by school districts plus the projected rate for pre-65 retirees, for whom some school district provide a portion of health insurance (Aneiro, 2004).

Strategies to Control Healthcare Costs

The key to mounting an offense against rising health insurance costs is to be proactive. Options do exist to reign in expenditures which will not only reduce Board and employee costs but help control the growing budget gap. By employing specific cost reduction strategies, school business officials can make a difference in healthcare premium costs.

Strategy 1: Educate Yourself on Costs

The world of healthcare is fraught with complexity often punctuated with complex formulas and industry jargon. As a result, school boards turn to their school business managers to explain confusing healthcare information and to guide them through the insurance maze. To be most effective in this role, business officials must learn as much as possible about all aspects of health insurance, particularly those related to costs. Understanding not only the health plan components but claim management is an essential first step to addressing overall healthcare premium cost containment.

Strategy 2: Analyze Premium Expenditures and Identify Areas for Cost Containment

All school business managers cannot be expected to have the breadth of knowledge necessary to understand fully the constantly changing health insurance landscape. Consequently, most school districts should seek outside expertise from an insurance industry expert if they want to leave no stone unturned in the search for cost containment. Two options available include the benefit manager or broker model and the independent cost benefit consultant.

The most common approach used in school districts is to rely on the expertise of their present insurance plan manager or broker employed to service their insurance programs. Since benefit consulting is a component of the manager/broker role, school districts may request their expertise as part of their contract services. Another approach is to employ a specific cost reduction consultant who will exclusively represent the district’s interests and contribute a high level industry-specific experience. Since consultant fees are usually based on a percentage of realized district cost savings, the cost-benefit ratio associated with a high-quality consultant who exclusively represents the local district cannot be overestimated.

Under either approach, a school district can expect to receive professional expertise to:

• Analyze present plan performance

• Evaluate the prescription drug program

• Facilitate cost-containment partnerships with employee groups

• Identify feasible cost containment opportunities which may be unknown to district personnel and estimate cost savings that could be realized

• Negotiate insurance program costs including commission/fixed fees, direct medical services and claim management

Strategy 3: Partner with Employees

To ensure that employees have some incentive to control health insurance costs or objectively consider adjustments in benefit service levels, a school district should avoid paying 100% of any employee group’s health insurance premium. In an era of collective bargaining not only with certificated staff but also support groups, this can prove to be a challenge. However, school district administrators know from experience that if employees are not required to contribute to their healthcare premiums that little incentive exists to effect any change in benefit levels or scope of services.

One approach successfully employed in school districts is to establish Employee Benefit Committees in which members have a vested interest in controlling benefit costs while simultaneously providing an acceptable level of coverage at a manageable cost to the employee groups. This approach is particularly effective since without a process employees will often turn a deaf ear to suggestions for health insurance program changes. Why do they resist? Since this is not their field of expertise, employees have a very limited understanding of health insurance programs and the related costs and therefore worry about making any change which might negatively impact themselves or a colleague. They often assume that the district’s primary motive is to reduce costs even if it means negatively affecting employees. Without confidence in their own ability to make informed decisions, how can employees consider any service level adjustments even if they will to reduce costs for everyone without significant impact on employees? School districts which succeed in bridging this chasm and learn how to work collaboratively with their employee groups dramatically increase their likelihood of controlling and even reducing health insurance costs.

Employee Benefit Committees are often district or consultant led. Either the district’s insurance broker/manager or a cost reduction consultant can play a pivotal role in facilitating the district-employee partnership. Not only can the specialists provide the knowledge and technical expertise necessary to identify viable solutions, they can increase the efficacy of the entire process. Whether a district chooses to manage its committee internally or employ a consultant, the following are important elements of this strategy:

• Ensure that the committee membership includes key representatives from the faculty, staff and administrative groups

• Consider including representatives from each district facility and/or employee group

• Educate members thoroughly about health insurance plans, costs and current issues

• Discuss the relationship between salary and health insurance costs relative to district expenditures particularly since employees often do not connect the two

• Promote a spirit of open discussion about all insurance-related issues to build credibility and collaboration

• Encourage “outside the box†thinking which may be a precursor to innovative solutions

• Present specific, concrete options which link to revised employ benefit costs and service levels changes

• Encourage extensive communication between committee members and their constituent groups which will build core employee support for any ultimately proposed changes

Establishing a trusting, “we are in this together†spirit built on a solid foundation of factual information can be the catalyst to successful change.

Strategy 4: Change Plan Design

As school district administrators work with their employee groups to identify cost reduction options, some will find that substantial savings may be attainable with a closer examination of the current plan design. By studying the substance of each employee health insurance option, often simple plan design changes can make a significant difference. If employee groups understand the plan components and the impact they have on health insurance premiums, they may be willing to make some adjustment without creating a medical care burden for colleagues while trimming insurance premiums enough to maintain even or lower rates for the following year. Areas that often offer the most promise for positive cost-benefit ratios include:

• Increasing deductibles

• Separating deductibles for hospitalization

• Introducing a separate emergency room deductible

• Requiring higher employee cost sharing for less clinically valuable services such as those for cosmetic purposes

• Reducing cost sharing proportion for employees who select cost-effective and cost-efficient plans

• Adjusting co-payments and agreeing to review them on a regular basis

• Initiating an HMO co-payment requirement for physician services

• Discouraging adverse selection by decreasing the attractiveness of the school district plan for employee dependents who are eligible for private sector health insurance

Plan changes such as these may actually be more cost effective for employees; particularly those who are not extensive healthcare users, because the reduction in employee premium costs may exceed increased out-of-pocket expenses.

Strategy 5: Manage Prescription Plans Aggressively

As high as overall healthcare costs are, even more dramatic are the annual increases in prescription drugs. For the period from 1999 to 2001 alone, consumers saw prescription drug expenditure increases of 19.7%, 16.4% and 15.7% respectively (Kaiser Family Foundation, 2004). Is it any wonder that healthcare premium increases are to a large extent driven by escalating prescription costs? School district employees, unlike their private sector counterparts, have long enjoyed substantially richer prescription drug benefits which have become a part of the culture of education. However, the impact of raising employee co-pays even moderately may be to make health insurance premium reductions possible.

Strategy 6: Promote Healthier Lifestyles

One often overlooked area which offers the potential to reduce long-term healthcare costs is employee wellness. The National Center for Disease Prevention and Health Promotion statistics show that the three actual causes of death in the United States for 2000 were:

• Tobacco use

• Poor Diet/Physical Inactivity

• Alcohol Consumption

Data also indicate that deaths related to poor diet/physical inactive have increased since 1990 (CDC, 2004). Since each of the three areas is lifestyle-related, any positive change in employee behavior is likely to lead to a reduction in healthcare expenses over a period of time.

What actions can school districts take to promote healthier lifestyles?

• Provide on-site wellness screening programs to help employees identify health risks

• Provide smoking cessation programs

• Feature employee profiles of individuals who have lost considerable weight or stopped smoking

• Offer monetary weight loss and smoking cessation incentives

• Work with fitness clubs to promote membership specials

• Sponsor employee participation in walks/runs that promote particular disease research

• Communicate disease management on a monthly basis by highlighting a disease per month

• Offer flu shots

• Highlight healthcare plan wellness features such as well baby care, immunizations, mammograms and prostrate screening

Although activities such as these may not have immediately measurable results, the long term prognosis for increased employee wellness and lower healthcare cost is good.

Strategy 7: Emphasize Disease Management

Most healthcare consultants as well as school districts which track insurance claim data know that the majority of claims come from a relatively small number of health plan participants and that as many as half the costs can be attributable to as few a 2% of the participants. Many of these participants suffer from chronic diseases such as: diabetes, asthma, congestive heart failure, HIV/AIDS, hypertension, depression and hepatitis C. Often employees either do not have the information or support necessary to manage fully their chronic ailment. District policies which help employees to understand and manage their chronic ailments may realize health cost reductions. To encourage more effective disease management for chronic illnesses:

• Emphasize early detection of chronic illnesses

• Identify clinical guidelines, standards and medical interventions

• Offer incentives to encourage the employee to be more proactive such premium reductions, reduced out-of-pocket expenses and enriched benefits for mail order drugs

• Educate patients about behavioral changes which may lead to increased treatment compliance

• Take advantage of disease management programs which are often available through the insurance plan

Not only will this strategy help reduce costs but it will lead to a more healthy and productive lifestyle for those who suffer from chronic illnesses.

Strategy 8: Consider Consumer-Driven Health Care

A relative new approach to employee healthcare benefits, which offers cost savings promise, is consumer-driven healthcare (CDHC). School districts considering CDHCs should make sure that they fully understand all aspects of CDHSs since they come in a variety of options and can be complex (Rossheim, 2005) Nonetheless, what is unique about CDHC plans is that they put the consumer at the center of the equation. The most common CDHC option which is traditionally offered in school districts is the flexible spending account (FSA) which allows for the sheltering of both employer and employee contributions. However, the “use it or lose it†requirement limits it attractiveness.

A new option available in 2004 as a result of the national Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 is the health savings account (HSA) which provides employees with financial incentives including affordable premiums and increased tax advantages (Gabel, 2005). Such plans align the employee’s healthcare decision-making with financial incentives which reward prudent and responsible behavior by employees while potentially reducing health premium costs for school districts. An HSA must be offered in conjunction with a regular health insurance plan with minimum annual deductible levels of $1,000 for a single plan and $2,000 for a family plan and much higher out-of pocket limits. Similar to FSAs, health savings accounts are tax free but unlike FSAs unspent monies may be carried over from year to year as well as between employers (Rossheim, 2005). FSAs typically are funded primarily by the employees but may also be contributed to by the school district. In either instance, the account is owned and controlled by the employee not the school district, although the management of the account is through the employer. As a result, employee may invest their HSA funds in a wide variety of investment option including mutual funds and guaranteed interest accounts within the limits of the district plan.

HSAs are not for everyone. They are most attractive for employees who anticipate low out-of-pocket expenses or those who pay a large portion of the family insurance premium themselves and anticipate minimal health expenses. For all other employees, the high deductibles and out-of-pocket requirements may make them considerably less attractive. School districts considering an HSA plan option should ensure that they have a full understanding all components.

For the foreseeable future, school districts will likely struggle to maintain a balance between revenues and expenditures while still offering outstanding educational programs and services. However, school district administrators who are proactive in health cost containment can have a positive impact on the expenditure side of the equation helping to contain the skyrocketing cots of healthcare.

References

Actual Causes of Death in the United States, (2004). National Center for Chronic Disease for Chronic Disease Prevention and Health Promotion. Retrieved January 3, 2005 from http://cdc.gov/nccdphp/factshheets/death_causes2000.htm

Aneiro, M. (2004). Rising Health Care Cost Could Ease in 2005. Retrieved January 10, 2005 from http://pf.inc.com/criticalnews/article/200410/healthcare.html

Gabel, J. R., Whitmore, H., Rice, T., & Lo Sasso, A. T. Employers’ Contradictory Views about Consumer-Driven Health Care: Results from a National Survey, 2004. Health Affairs. Retrieved January 6, 2005 from http://content.healthaffairs.org/cgi/reprint/hlthaff.w4.210V1

Health Costs Skyrocket (2004). CNN Money. Retrieved December 2, 2004, from http://money.cnn.com/2003/09/09/pf/insurance/emploerhealthplans

Illinois Association of School Administrators (2004). Building Consensus on School Reform. IASA News and Notes. Retrieved January 7, 2005, from http://www.iasa.edu/publications/newsandnotes-december16.htm#Reform

Kaiser Family Foundation and Health Research and Educational Trust Report (2004). Employer Health Benefits 2004 Annual Survey: Cost of Health Insurance. Retrieved January 6, 2005, from http://www.kff.org/insurance/7148/sections/index.cfm

Kersten, T. A. & Armour, N. (2004). Education Fund Rate Increase: You Can Pass It. The Journal of School Business Management, v.16(2).

Miller, A. E. (2005). ASBO Members Voice Their Concerns and Desires. School Business Affairs, v. 71 (1).

Rossheim, J. (2005). Consumer-Driven Healthcare Plans. Retrieved January 6, 2005 from http://content.salary.monster.com/articles/consumerhealthcare

Schiller, R. E. and Steiner, J (2003). The Condition of Public Education. Illinois State Board of Education. Retrieved November 24, 2004, from http://www.iabe.net/finance/default.htm/budget/FY05/2003_Condition_of_Public_Education.pdf

Sloane, T. (2004). Rising Healthcare Costs Threaten the Best-laid Plans to Expand Access to Care. Modern Healthcare, v. 34(40).

US Department of Labor Bureau of Labor Statistics (2004). Consumer Price Index. US Department of Labor. Retrieved January 7, 2005, from http://www.bls.gov/schedule/archives/cpi_nr.htm

About the Authors

Dr. Thomas A. Kersten is the retired Superintendent of Skokie SD 68, Skokie, IL and Asst. Professor of Educational Leadership at Roosevelt University. Mohsin Dada is Asst. Supt./Business Services & Treasurer of Schaumburg CCSD 54, Schaumburg, IL